Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

US Economic Growth Slows Sharply in Q1 2024 Amid Persistent Inflation

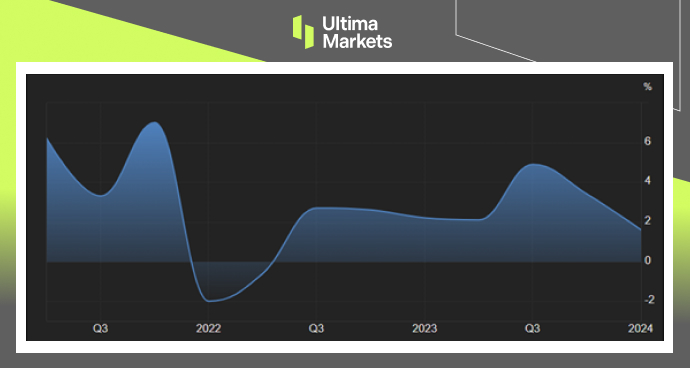

TOPICSThe US economy expanded at an annualized rate of 1.6% in Q1 2024, the slowest growth since the contractions in the first half of 2022. The reading was lower than the previous quarter’s 3.4% growth and below the forecasted 2.5%. Consumer spending growth decreased to 2.5% from 3.3%, mainly due to a 0.4% fall in goods consumption, while spending on services rose faster at 4% compared to 3.4% in the previous quarter. Non-residential investment eased to 2.9% from 3.7%, driven by a 0.1% decline in structures investment, although investment in equipment rebounded to 2.1% from -1.1%, and investment in intellectual property products accelerated to 5.4% from 4.3%.

Exploring further, government spending rose at a slower pace of 1.2% compared to 4.6% in the previous quarter. Exports dropped sharply to 0.9% from 5.1%, while imports soared to 7.2% from 2.2%. In addition, private inventories subtracted 0.35 percentage points from growth, compared to a 0.47 percentage point subtraction in the previous quarter. On the contrary, residential investment jumped at a double-digit pace of 13.9%, up from 2.8% in the previous quarter.

(U.S. GDP Growth Rate,Bureau of Economic Analysis)

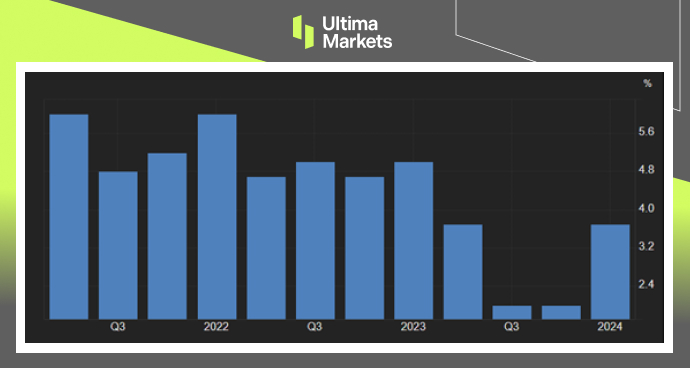

During the first quarter of 2024, the Core Personal Consumption Expenditures (Core PCE) price index, which omits food and energy costs, climbed by 3.7% on an annual basis. This marks a speed up from the 2% rise seen in the prior quarter and surpasses the forecasted 3.4%. Meanwhile, the overall PCE price index saw a 3.4% annual increase, up from the 1.8% growth recorded in the previous quarter.

(U.S. Core PCE QoQ,Bureau of Economic Analysis)

US stocks closed sharply lower on Thursday after the GDP release showed a sharp economic slowdown and persistent inflation. The S&P 500 lost roughly 0.5%, the Dow Jones tumbled 375 points (-0.98%) after dropping 540 points earlier, and the Nasdaq fell 0.6%. Disappointing earnings reports from companies like Meta (-10.56%) and IBM (-8.25%) also weighed on sentiments. Honeywell International’s stock lost 0.9% despite its upbeat results.

(S&P500 Index Monthly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.