U.S. Consumer Price Index (CPI): Forex Impact and Strategy Guide

For many Taiwanese investors, “rising prices” is undoubtedly the most tangible economic change they experience. From higher vegetable prices at the dinner table to fluctuations in gasoline costs, inflation continuously impacts daily life. The U.S. Consumer Price Index (CPI), one of the core indicators for measuring inflation, serves not only as a barometer of the U.S. economy but also as a crucial “weather vane” for the forex market.

The CPI is closely linked to the Federal Reserve’s monetary policy, interest rate decisions, and the value of the U.S. dollar. When CPI data rises beyond expectations, it often fuels rate hike anticipations, subsequently strengthening the dollar. For forex traders worldwide, this signals substantial market volatility and abundant investment opportunities.

Ultima Markets Reminder: Research shows that approximately 70% of exchange rate fluctuations coincide with CPI data release windows. Therefore, mastering the timing and interpretation of CPI data is critical for seizing opportunities in the forex market.

In-Depth Analysis: How the U.S. CPI Functions

What Is CPI?

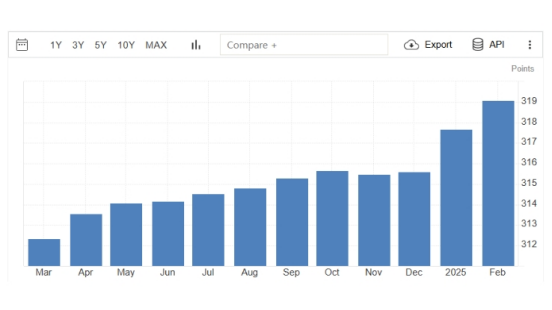

The U.S. Consumer Price Index (CPI) measures the price changes of a basket of goods and services, serving as a gauge of inflation intensity. The U.S. Bureau of Labor Statistics (BLS) releases CPI data monthly, reflecting fluctuations in consumer goods prices. Changes in CPI indicate shifts in living costs and directly influence the Federal Reserve’s monetary policy adjustments.

Taiwan Comparison: Differences from Taiwan’s Directorate-General of Budget, Accounting and Statistics CPI

Taiwan’s CPI data is published by the Directorate-General of Budget, Accounting and Statistics (DGBAS). Although the underlying principles are similar, differences in living costs and consumption patterns lead to variations in the statistical methods and category compositions between Taiwan’s and the U.S.’s CPI. Understanding these differences helps Taiwanese investors interpret CPI data accurately from a global perspective.

Core CPI vs Headline CPI

Within CPI data, “Core CPI,” which excludes food and energy prices, is the indicator most closely watched by the Federal Reserve and investors. Because food and energy prices are highly volatile and may distort the reflection of long-term inflation trends, the Fed prefers to reference Core CPI when assessing underlying inflationary pressures in the economy.

Details of Data Release

The monthly CPI data is typically released at the beginning of each month at 8:30 AM Eastern Time (8:30 PM Taipei Time). Taiwanese investors can access real-time data through the official website of the U.S. Bureau of Labor Statistics (BLS).

As a forex trader, by subscribing to Ultima Markets’ Economic Calendar, you can receive timely updates on global CPI data, helping you make precise trading decisions before and after data releases.

How Does CPI Ignite the Forex Market? Logical Chain Breakdown

Direct Impact Path

CPI Exceeds Expectations → Heightened Rate Hike Expectations → U.S. Dollar Appreciation → Pressure on Non-U.S. Currencies

When CPI data surpasses expectations, investors generally anticipate that the Federal Reserve may raise interest rates to combat inflation, leading to a stronger U.S. dollar. A stronger dollar, in turn, exerts pressure on non-U.S. currencies, particularly major pairs like EUR/USD and USD/JPY.

Historical Case: CPI Surge in 2023 Triggers 1.5% One-Day Move in the Dollar Index

In December 2023, U.S. CPI data significantly exceeded expectations, causing the dollar index to jump by 1.5% within the day and broadly impacting global equity markets. This surge in market volatility created substantial profit opportunities for forex traders, particularly in short-term operations involving dollar-related currency pairs.

Indirect Impact Dimensions

- 1.Risk Sentiment: High Inflation Triggers Safe-Haven Demand (JPY and CHF)

High inflation often intensifies market risk sentiment, prompting investors to seek safe-haven assets like the Japanese yen (JPY) and the Swiss franc (CHF). This drives appreciation in these currencies, especially when CPI data falls short of expectations.

- 2.Central Bank Policy Divergence: Arbitrage Opportunities from ECB/BOJ Reaction Differences

While CPI data impacts the Federal Reserve’s monetary policy, the European Central Bank (ECB) and Bank of Japan (BOJ) may react differently, creating arbitrage opportunities within the forex market.

Key Points for Taiwanese Traders

- TWD Correlation:When the U.S. dollar strengthens sharply, Taiwanese investors should monitor the USD/TWD NDF market response, especially when CPI data exceeds expectations, as the dollar may exert significant influence on the New Taiwan dollar.

Practical Strategies: Trading Tips Before and After CPI Releases

Before Data Release

- 1.Expectation Management:Market consensus and the “buy the rumor” phenomenon can influence CPI reactions. Understanding expectations and formulating corresponding strategies help you better seize trading opportunities.

- 2.Positioning: Through Ultima Markets’ pending order strategies (breakout orders/range limit orders), you can pre-position ahead of the data release to avoid missing opportunities due to sudden market moves.

At the Moment of Data Release

Scenario-Based Responses: Prepare operational templates for different outcomes (above/meeting/below expectations) after the CPI release to react swiftly to market changes.

After Data Release

- 1.”Buy the Rumor, Sell the Fact” Trap Identification:Many traders may rush into the market based on initial CPI reactions, but often the market undergoes short-term corrections after data releases. Recognizing this helps avoid the typical “buy the rumor, sell the fact” trading mistake.

- 2.Combining Technical Analysis:After the data release, using the Fibonacci retracement tools on the UM MT5 platform can help you accurately capture market pullback ranges and optimize trading decisions.

Ultima Markets Exclusive Resources: Accurately Capture CPI Movements

Exclusive Tool Support

- Real-Time CPI Data Alerts + Professional Chart Interpretation:Ultima Markets provides real-time CPI data updates combined with expert chart analysis, helping you swiftly capture immediate market trends.

- Trading Calculator:Using the trading calculator, you can combine forecast data to estimate potential volatility ranges for major currency pairs after CPI releases, allowing you to pre-plan your trades.

- Account Type Matching Strategies:

- ECN Account:Ideal for capturing short-term movements, offering zero spreads and ensuring fast execution.

- Hedging Account:Suitable for mitigating unilateral risks, providing a more stable trading environment.

Educational Resources Empowerment

- CPI Special Analysis:UM integrates top-tier Trading Central tools, offering professional technical analysis and trading strategy recommendations. By leveraging Trading Central’s trendlines, key price levels, and technical outlooks, you can easily interpret CPI movements and act immediately.

- Beginner Courses:Understand the relationship between inflation indicators and macroeconomics, helping beginner investors quickly build trading skills from the ground up.

Frequently Asked Questions

Q1: What Time Is CPI Released in Taipei? How About Daylight Saving Time Differences?

A1: During Daylight Saving Time, Taiwanese investors should adjust the CPI release to 8:30 PM Taipei Time; otherwise, during Standard Time, it is at 9:30 PM.

Q2: How Does the CPI “Revised Value” Affect Trading?

A2: U.S. CPI data is usually subject to “revisions” after the initial release, as the preliminary figures are estimated based on early sample collections. The revised data reflects more accurate statistical results. For forex traders, these revisions can have a significant impact on market movements, especially when there is a large discrepancy between the initial release and the revised figures.

If the revised data indicates that inflationary pressure is higher or lower than originally expected, it could alter market expectations regarding Federal Reserve policy and, in turn, impact the movement of the U.S. dollar. Therefore, investors should closely monitor data revisions after release, especially their effects on USD-related currency pairs.

Q3: How to Avoid Slippage Risk During CPI Movements?

A3: Slippage refers to the difference between the expected order execution price and the actual executed price under highly volatile market conditions. During CPI data releases, markets often experience extreme volatility, increasing the risk of slippage. To mitigate this risk, investors can adopt the following measures:

- 1.Use Limit Orders: Limit orders allow you to set a desired execution price, helping prevent trades from executing at prices higher or lower than expected during sharp market swings.

- 2.Choose a Low-Latency Trading Platform: Execution latency directly affects the accuracy of order fulfillment. Choosing a platform like Ultima Markets, which offers low-latency execution, helps reduce slippage risk.

- 3.Utilize Liquidity Protection Services: Ultima Markets offers slippage protection policies, partnering with top-tier liquidity providers to ensure efficient trade execution and minimize slippage risks.

Q4: Besides CPI, What Other U.S. Indicators Should Be Watched?

A4: In addition to CPI, investors should also monitor the following U.S. economic indicators, which similarly have significant market impact:

- 1.PPI (Producer Price Index): PPI measures price changes at the production level and is often regarded as a leading indicator of inflationary pressure. If PPI data shows rising prices, it could suggest an upcoming increase in CPI, further influencing the Federal Reserve’s rate hike decisions.

- 2.PCE (Personal Consumption Expenditures Index): PCE is one of the Federal Reserve’s most closely watched inflation indicators, measuring price changes in consumer spending. PCE is typically more comprehensive than CPI and therefore has a greater impact on Fed policy decisions.

- 3.Nonfarm Payrolls: The initial release of Nonfarm Payrolls each month usually causes sharp market movements. The strength or weakness of these figures directly reflects the health of the labor market and influences the Federal Reserve’s interest rate policies.

- 4.Federal Funds Rate Decision: The Fed regularly holds meetings each year to set interest rates, and each post-meeting policy statement can trigger significant fluctuations in the U.S. dollar.

In summary, CPI data provides directional guidance for medium- to long-term trends in the forex market. Mastering the release and interpretation of CPI figures, while utilizing professional tools for effective risk management, can greatly enhance trading efficiency.

Register your trading account now and embark on your forex trading journey, using platform tools and resources to meet the upcoming market challenges head-on.

Glossary

Get started or expand your knowledge of trading at any level with a wealth of financial industry terms and definitions that you won’t find anywhere else.

- A

- B

- C

- D

- E

- F

- G

- H

- I

- J

- K

- L

- M

- N

- O

- P

- Q

- R

- S

- T

- U

- V

- W

- X

- Y

- Z

Bookmarked Trading Term(s)

Glossary

- A

- B

- C

- D

- E

- F

- G

- H

- I

- J

- K

- L

- M

- N

- O

- P

- Q

- R

- S

- T

- U

- V

- W

- X

- Y

- Z

-

AMM (Automated Money Market)

A decentralized system that uses algorithms to automatically manage liquidity and trading in financial markets without traditional market makers.

Bookmark

-

APR (Annual Percentage Rate)

The yearly interest rate a trader pays on borrowed funds or e arns on investments, excluding compounding.

Bookmark

-

APY (Annual Percentage Yield)

The yearly interest rate a trader earns, including compounding, which reflects the real return on an investment.

Bookmark

-

Asymmetric Cryptography

A security method using two different keys (public and private) to encrypt and decrypt data, ensuring secure transactions.

Bookmark

-

Asymmetric Encryption

The apportionment of premiums and discounts on forward exchange transactions that relate directly to deposit swap (interest arbitrage) deals, over the period of each deal.

Bookmark

-

Atomic Swap

A direct peer-to-peer exchange of different cryptocurrencies without the need for intermediaries, reducing counterparty risk.

Bookmark

-

Balance Of Trade

The value of a country's exports minus its imports.

Bookmark

-

Bar Chart

A type of chart which consists of four significant points: the high and the low prices, which form the vertical bar; the opening price, which is marked with a horizontal line to the left of the bar; and the closing price, which is marked with a horizontal line to the right of the bar.

Bookmark

-

Barrier Level

A certain price of great importance included in the structure of a Barrier Option. If a Barrier Level price is reached, the terms of a specific Barrier Option call for a series of events to occur.

Bookmark

-

Barrier Option

Any number of different option structures (such as knock-in, knock-out, no touch, double-no-touch-DNT) that attaches great importance to a specific price trading. In a no-touch barrier, a large defined payout is awarded to the buyer of the option by the seller if the strike price is not 'touched' before expiry. This creates an incentive for the option seller to drive prices through the strike level and creates an incentive for the option buyer to defend the strike level.

Bookmark

-

Base Currency

The first currency in a currency pair. It shows how much the base currency is worth as measured against the second currency. For example, if the USD/CHF (U.S. Dollar/Swiss Franc) rate equals 1.6215, then one USD is worth CHF 1.6215. In the forex market, the US dollar is normally considered the base currency for quotes, meaning that quotes are expressed as a unit of $1 USD per the other currency quoted in the pair. The primary exceptions to this rule are the British pound, the euro and the Australian dollar.

Bookmark

-

Cable

The GBP/USD (Great British Pound/U.S. Dollar) pair. Cable earned its nickname because the rate was originally transmitted to the US via a transatlantic cable beginning in the mid 1800s when the GBP was the currency of international trade.

Bookmark

-

Cad

The Canadian dollar, also known as Loonie or Funds.

Bookmark

-

Call Option

A currency trade which exploits the interest rate difference between two countries. By selling a currency with a low rate of interest and buying a currency with a high rate of interest, the trader will receive the interest difference between the two countries while this trade is open.

Bookmark

-

Canadian Ivey Purchasing Managers (Cipm) Index

A monthly gauge of Canadian business sentiment issued by the Richard Ivey Business School.

Bookmark

-

Candlestick Chart

A chart that indicates the trading range for the day as well as the opening and closing price. If the open price is higher than the close price, the rectangle between the open and close price is shaded. If the close price is higher than the open price, that area of the chart is not shaded.

Bookmark

-

Day Trader

Speculators who take positions in commodities and then liquidate those positions prior to the close of the same trading day.

Bookmark

-

Day Trading

Making an open and close trade in the same product in one day.

Bookmark

-

Deal

A term that denotes a trade done at the current market price. It is a live trade as opposed to an order.

Bookmark

-

Dealer

An individual or firm that acts as a principal or counterpart to a transaction. Principals take one side of a position, hoping to earn a spread (profit) by closing out the position in a subsequent trade with another party. In contrast, a broker is an individual or firm that acts as an intermediary, putting together buyers and sellers for a fee or commission.

Bookmark

-

Dealing Spread

The difference between the buying and selling price of a contract.

Bookmark

-

Ecb

European Central Bank, the central bank for the countries using the euro.

Bookmark

-

Economic Indicator

A government-issued statistic that indicates current economic growth and stability. Common indicators include employment rates, Gross Domestic Product (GDP), inflation, retail sales, etc.

Bookmark

-

End Of Day Order (eod)

An order to buy or sell at a specified price that remains open until the end of the trading day.

Bookmark

-

Est/Edt

The time zone of New York City, which stands for United States Eastern Standard Time/Eastern Daylight time.

Bookmark

-

Estx50

A name for the Euronext 50 index.

Bookmark

-

Factory Orders

The dollar level of new orders for both durable and nondurable goods. This report is more in depth than the durable goods report which is released earlier in the month.

Bookmark

-

Fed

The Federal Reserve Bank, the central bank of the United States, or the FOMC (Federal Open Market Committee), the policy-setting committee of the Federal Reserve.

Bookmark

-

Fed Officials

Refers to members of the Board of Governors of the Federal Reserve or regional Federal Reserve Bank Presidents.

Bookmark

-

Figure/The Figure

Refers to the price quotation of '00' in a price such as 00-03 (1.2600-03) and would be read as 'figure-three.' If someone sells at 1.2600, traders would say 'the figure was given' or 'the figure was hit.

Bookmark

-

Fill

When an order has been fully executed.

Bookmark

-

G7

Group of 7 Nations - United States, Japan, Germany, United Kingdom, France, Italy and Canada.

Bookmark

-

G8

Group of 8 - G7 nations plus Russia.

Bookmark

-

Gap Gapping

A quick market move in which prices skip several levels without any trades occurring. Gaps usually follow economic data or news announcements.

Bookmark

-

Gearing (Also Known As Leverage)

Gearing refers to trading a notional value that is greater than the amount of capital a trader is required to hold in his or her trading account. It is expressed as a percentage or a fraction.

Bookmark

-

Ger30

An index of the top 30 companies (by market capitalization) listed on the German stock exchange – another name for the DAX.

Bookmark

-

Handle

Every 100 pips in the FX market starting with 000.

Bookmark

-

Hawk/Hawkish

A country's monetary policymakers are referred to as hawkish when they believe that higher interest rates are needed, usually to combat inflation or restrain rapid economic growth or both.

Bookmark

-

Hedge

A position or combination of positions that reduces the risk of your primary position.

Bookmark

-

Hit The Bid

To sell at the current market bid.

Bookmark

-

Hk50/Hkhi

Names for the Hong Kong Hang Seng index.

Bookmark

-

Illiquid

Little volume being traded in the market; a lack of liquidity often creates choppy market conditions.

Bookmark

-

Imm

The IMM, or International Monetary Market, is a part of the Chicago Mercantile Exchange (CME) that deals with trading currency and interest rate futures and options.

Bookmark

-

Imm Futures

A traditional futures contract based on major currencies against the US dollar. IMM futures are traded on the floor of the Chicago Mercantile Exchange.

Bookmark

-

Imm Session

8:00am - 3:00pm New York.

Bookmark

-

Indu

Abbreviation for the Dow Jones Industrial Average.

Bookmark

-

Japanese Economy Watchers Survey

Measures the mood of businesses that directly service consumers such as waiters, drivers and beauticians. Readings above 50 generally signal improvements in sentiment.

Bookmark

-

Japanese Machine Tool Orders

Measures the total value of new orders placed with machine tool manufacturers. Machine tool orders are a measure of the demand for companies that make machines, a leading indicator of future industrial production. Strong data generally signals that manufacturing is improving and that the economy is in an expansion phase.

Bookmark

-

Jpn225

A name for the NEKKEI index.

Bookmark

-

Keep The Powder Dry

To limit your trades due to inclement trading conditions. In either choppy or extremely narrow markets, it may be better to stay on the sidelines until a clear opportunity arises.

Bookmark

-

Kiwi

Nickname for NZD/USD (New Zealand Dollar/U.S. Dollar).

Bookmark

-

Knock-Ins

Option strategy that requires the underlying product to trade at a certain price before a previously bought option becomes active. Knock-ins are used to reduce premium costs of the underlying option and can trigger hedging activities once an option is activated.

Bookmark

-

Knock-Outs

Option that nullifies a previously bought option if the underlying product trades a certain level. When a knock-out level is traded, the underlying option ceases to exist and any hedging may have to be unwound.

Bookmark

-

Last Dealing Day

The last day you may trade a particular product.

Bookmark

-

Last Dealing Time

The last time you may trade a particular product.

Bookmark

-

Leading Indicators

Statistics that are considered to predict future economic activity.

Bookmark

-

Level

A price zone or particular price that is significant from a technical standpoint or based on reported orders/option interest.

Bookmark

-

Leverage

Also known as margin, this is the percentage or fractional increase you can trade from the amount of capital you have available. It allows traders to trade notional values far higher than the capital they have. For example, leverage of 100:1 means you can trade a notional value 100 times greater than the capital in your trading account.*

Bookmark

-

Macro

The longest-term trader who bases their trade decisions on fundamental analysis. A macro trade’s holding period can last anywhere from around six months to multiple years.

Bookmark

-

Manufacturing Production

Measures the total output of the manufacturing aspect of the Industrial Production figures. This data only measures the 13 sub-sectors that relate directly to manufacturing. Manufacturing makes up approximately 80% of total Industrial Production.

Bookmark

-

Market Call

A request from a broker or dealer for additional funds or other collateral on a position that has moved against the customer.

Bookmark

-

Market Maker

A dealer who regularly quotes both bid and ask prices and is ready to make a two-sided market for any financial product.

Bookmark

-

Market Order

An order to buy or sell at the current price.

Bookmark

-

Nas100

An abbreviation for the NASDAQ 100 index.

Bookmark

-

Net Position

The amount of currency bought or sold which has not yet been offset by opposite transactions.

Bookmark

-

New York Session

8:00am – 5:00pm (New York time).

Bookmark

-

No Touch

An option that pays a fixed amount to the holder if the market never touches the predetermined Barrier Level.

Bookmark

-

Nya.X

Symbol for NYSE Composite index.

Bookmark

-

Offer (Also Known As The Ask Price)

The price at which the market is prepared to sell a product. Prices are quoted two-way as Bid/Offer. The Offer price is also known as the Ask. The Ask represents the price at which a trader can buy the base currency, which is shown to the right in a currency pair. For example, in the quote USD/CHF 1.4527/32, the base currency is USD, and the ask price is 1.4532, meaning you can buy one US dollar for 1.4532 Swiss francs.

In CFD trading, the Ask represents the price a trader can buy the product. For example, in the quote for UK OIL 111.13/111.16, the product quoted is UK OIL and the ask price is £111.16 for one unit of the underlying market.

Bookmark

-

Offered

If a market is said to be trading offered, it means a pair is attracting heavy selling interest, or offers.

Bookmark

-

Offsetting Transaction

A trade that cancels or offsets some or all of the market risk of an open position.

Bookmark

-

On Top

Attempting to sell at the current market order price.

Bookmark

-

One Cancels The Other Order (oco)

A designation for two orders whereby if one part of the two orders is executed, then the other is automatically cancelled.

Bookmark

-

Paid

Refers to the offer side of the market dealing.

Bookmark

-

Pair

The forex quoting convention of matching one currency against the other.

Bookmark

-

Paneled

A very heavy round of selling.

Bookmark

-

Parabolic

A market that moves a great distance in a very short period of time, frequently moving in an accelerating fashion that resembles one half of a parabola. Parabolic moves can be either up or down.

Bookmark

-

Partial Fill

When only part of an order has been executed.

Bookmark

-

Quantitative Easing

When a central bank injects money into an economy with the aim of stimulating growth.

Bookmark

-

Quarterly Cfds

When a central bank injects money into an economy with the aim of stimulating growth.

Bookmark

-

Quote

An indicative market price, normally used for information purposes only.

Bookmark

-

Rally

A recovery in price after a period of decline.

Bookmark

-

Range

When a price is trading between a defined high and low, moving within these two boundaries without breaking out from them.

Bookmark

-

Rate

The price of one currency in terms of another, typically used for dealing purposes.

Bookmark

-

Rba

Reserve Bank of Australia, the central bank of Australia.

Bookmark

-

Rbnz

Reserve Bank of New Zealand, the central bank of New Zealand.

Bookmark

-

Sec

The Securities and Exchange Commission.

Bookmark

-

Sector

A group of securities that operate in a similar industry.

Bookmark

-

Sell

Taking a short position in expectation that the market is going to go down.

Bookmark

-

Settlement

The process by which a trade is entered into the books, recording the counterparts to a transaction. The settlement of currency trades may or may not involve the actual physical exchange of one currency for another.

Bookmark

-

Shga.X

Symbol for the Shanghai A index

Bookmark

-

Takeover

Assuming control of a company by buying its stock.

Bookmark

-

Technical Analysis

The process by which charts of past price patterns are studied for clues as to the direction of future price movements.

Bookmark

-

Technicians/techs

Traders who base their trading decisions on technical or charts analysis.

Bookmark

-

Ten (10) Yr

US government-issued debt which is repayable in ten years. For example, a US 10-year note.

Bookmark

-

Thin

A illiquid, slippery or choppy market environment. A light-volume market that produces erratic trading conditions.

Bookmark

-

Ugly

Describing unforgiving market conditions that can be violent and quick.

Bookmark

-

Uk Average Earnings Including Bonus/ Excluding Bonus

Measures the average wage including/excluding bonuses paid to employees. This is measured quarter-on-quarter (QoQ) from the previous year.

Bookmark

-

Uk Claimant Count Rate

Measures the number of people claiming unemployment benefits. The claimant count figures tend to be lower than the unemployment data since not all of the unemployed are eligible for benefits.

Bookmark

-

Uk Hbos House Price Index

Measures the relative level of UK house prices for an indication of trends in the UK real estate sector and their implication for the overall economic outlook. This index is the longest monthly data series of any UK housing index, published by the largest UK mortgage lender (Halifax Building Society/Bank of Scotland).

Bookmark

-

Uk Jobless Claims Change

Measures the change in the number of people claiming unemployment benefits over the previous month.

Bookmark

-

Value Date

Also known as the maturity date, it is the date on which counterparts to a financial transaction agree to settle their respective obligations, i.e., exchanging payments. For spot currency transactions, the value date is normally two business days forward.

Bookmark

-

Variation Margin

Funds traders must hold in their accounts to have the required margin necessary to cope with market fluctuations.

Bookmark

-

Vix Or Volatility Index

Shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge."

Bookmark

-

Volatility

Referring to active markets that often present trade opportunities.

Bookmark

-

Wedge Chart Pattern

Chart formation that shows a narrowing price range over time, where price highs in an ascending wedge decrease incrementally, or in a descending wedge, price declines are incrementally smaller. Ascending wedges typically conclude with a downside breakout and descending wedges typically terminate with upside breakouts.

Bookmark

-

Whipsaw

Slang for a highly volatile market where a sharp price movement is quickly followed by a sharp reversal.

Bookmark

-

Wholesale Price

Measures the changes in prices paid by retailers for finished goods. Inflationary pressures typically show earlier than the headline retail.

Bookmark

-

Working Order

Where a limit order has been requested but not yet filled.

Bookmark

-

Wsj

Acronym for The Wall Street Journal.

Bookmark

-

Xag/Usd

Symbol for Silver Index.

Bookmark

-

Xau/Usd

Symbol for Gold Index.

Bookmark

-

Xax.X

Symbol for AMEX Composite Index.

Bookmark

-

YER

Yemeni Rial. The currency of Yemen. It is subdivided into 100 fils.

Bookmark

-

Yemeni Rial

See YER.

Bookmark

-

Yen

See JPY.

Bookmark

-

Yield

Yield is the return on an investment and is usually expressed as a percentage.

Bookmark

-

Yuan Renminbi

See CNY

Bookmark

-

ZAR

Rand. The currency of South Africa. It is subdivided into 100 cents.

Bookmark

-

ZMW

Zambian Kwacha. The currency of Zambia. It is subdivided into 100 Ngwee.

Bookmark

-

ZWL

Zimbabwe Dollar. The currency of Zimbabwe. It is subdivided into 100 cents.

Bookmark

-

Zambian Kwacha

See ZMW.

Bookmark

-

ZigZag

A technical indicator that draws tops and bottoms - filtering out noise.

Bookmark

-

Zimbabwe Dollar

See ZWL.

Bookmark

Bookmarked Trading Term(s)

Cancel

Confirm