You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

ECB Rate Cut Prospects Intensify as Economic Clouds Gather

TOPICSThe independent European Central Bank (ECB), an integral part of the Eurosystem, is responsible for managing the monetary policy of the euro area that comprises twenty nations. It is based in Frankfurt, Germany, and works in conjunction with the national central banks of the euro area member states. The ECB’s primary goal, through its governing council, is to maintain price stability. It administers a uniform monetary policy under a single monetary authority. Comparatively, the ECB faces more complex scenarios than its U.S. counterpart.

In the United States, the Federal Reserve chose to maintain the current interest rates in its January meeting. Going by the current economic conditions in the U.S. and the Federal Reserve’s approach, the cycle of raising interest rates appears to have ended. Moreover, the Fed Chair has refrained from suggesting any future interest rate increases. This decision finds support in objective data, such as a reduction in the Personal Consumption Expenditures (PCE) price index to 2.6%. Both official and private forecasts predict a drop in inflation to around 2% within the year.

Despite the near-zero chance of an interest rate cut in March, Federal Reserve officials have announced potential rate cuts within the year, but these will require patience. On the contrary, the ECB might take the initiative with an interest rate cut in the summer due to facing stricter limitations than the Fed. ECB President Christine Lagarde’s movements are restrained by time constraints and economic fragility in the Eurozone.

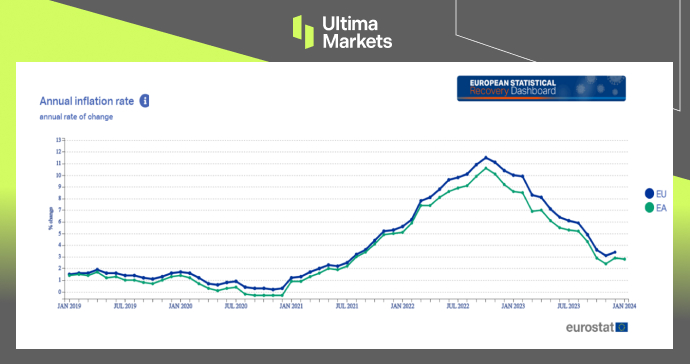

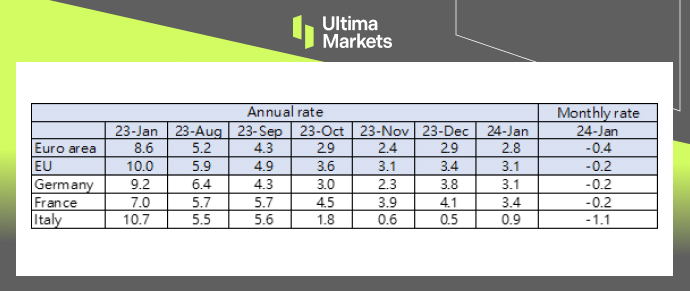

We must look closely at key economic indicators to understand the challenges faced by the ECB. The euro area (EA) annual inflation rate was 2.8% in January 2024, down from 2.9% in December. A year earlier, the rate was 8.6%. In January 2024, the annual inflation rate of the European Union (EU) was 3.1%, a decrease from 3.4% in December. The rate was significantly higher a year ago, reaching 10.0%. Germany, France, and Italy, the three largest economies in EA, have made substantial progress in combating inflation, with numbers stabilizing under 4%.

Services had the biggest upward impact on eurozone inflation in January (+1.73%), trailed by food, alcohol & tobacco (+1.13%), non-energy industrial goods (+0.53%), while energy provided a negative contribution (-0.62%). Low oil prices indeed helped significantly reduce overall inflation. Currently, elevated services prices appear to be a major hurdle in fully taming inflation. Addressing EU legislators, ECB President Lagarde stated that wage pressures persist at high levels and reiterated that wages will likely become an increasingly crucial driver of price movements over the coming quarters. The ECB has long maintained that key data on 2024 wage settlements will only emerge in May, so the June policy meeting will be the first opportunity for policymakers to assess whether rapid wage growth is decelerating based on evidence.

(Annual inflation rate)

(Inflation rates % measured by the HICP)

(Contributions to the euro area annual inflation rate %, selected aggregates)

The Euro’s economic growth has been slow. February’s initial evaluation of the Eurozone Composite PMI, put together by S&P Global, escalated to 48.9, a growth of 1 point from 47.9 in January, and it surpassed the 48.5 forecasted by economists in a Reuters survey, largely owed to an unpredicted surge in the service sector. Yet, the index stayed under 50, the line demarcating growth from recession, for the ninth month straight, suggesting the economy is still not free from contraction.

The survey presented on February 22nd indicated a rise in the Eurozone’s services PMI, moving to 50.0 in February from 48.4 in January. It notably surpassed the 48.8 prediction by economic experts. In contrast, a slight decrease was observed in the manufacturing PMI, from 46.6 to 46.1, reflecting an intensified recession and dashing economists’ hopes who projected the index to ascend to 47.0. The Eurozone’s manufacturing PMI has registered below 50 since July 2022.

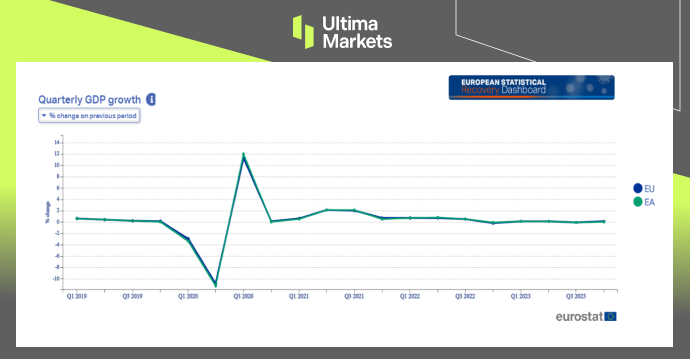

The European Commission has announced a modest GDP growth of just 0.1% in the last quarter of 2023. While the fog of inflation is slowly lifting, this year’s economic advancement in the Eurozone might not meet expectations. The commission has thus revised its annual growth forecast for the Eurozone economies. It reported the GDP increase this year for the Eurozone to be slightly more than the 0.5% of last year, projecting a growth of 0.8%. Correspondingly, the 2025 prediction has been adjusted from 1.6% down to 1.5%. Germany, being the biggest economy in the Eurozone, has reduced its growth prediction for 2024 from the initial 0.8% to a meager 0.3%. Consequently, there are concerns across Europe of a possible recession looming.

(Quarterly GDP growth)

There’s scant proof that the European Central Bank will hang back until the Federal Reserve makes its move. Current economic indicators point towards an increasing divergence, with data from the United States hinting at a delayed timeline for Fed rate cuts, while data from the eurozone is exerting pressure on the ECB for earlier rate reductions. Historically, the Fed has often been proactive in its monetary policy decisions compared to the ECB. During the dot-com crash in 2000, the Fed reduced rates five months before the ECB followed suit. Similarly, in 2007, just prior to the 2008 financial crisis, the Fed cut rates over a year earlier than its European counterpart. More recently, in March 2022, the Fed acted ahead of the ECB by initiating rate hikes to combat post-pandemic inflation. This time around, factors such as lower inflation rates and Germany’s economic slowdown support the notion that the ECB may opt for rate cuts sooner and more aggressively than the Fed.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.