Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

China’s Deflation Haze Temporarily Dissipates, Market Awaits Trade Barrier Developments

TOPICSChina’s annual inflation rate rose to 0.3% in April 2024, surpassing market estimates and the previous month’s figure of 0.1%. It marked the third consecutive month of consumer inflation, amid an ongoing recovery in domestic demand despite a fragile economic revival.

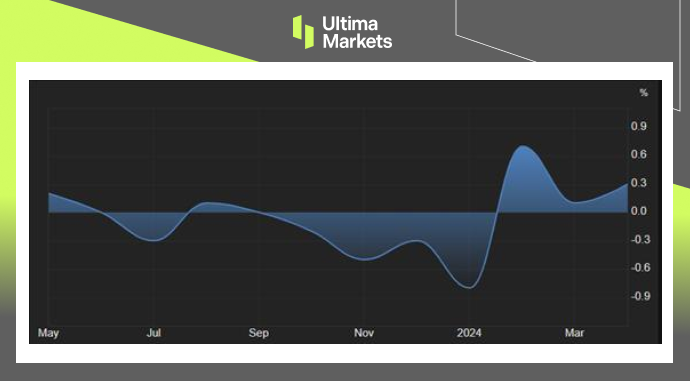

Non-food inflation accelerated to 0.9% from 0.7% in March. Simultaneously, transport costs added 0.1% after falling 1.3% in the prior month, as some local governments recently raised utility prices, such as natural gas and train fares. On the food side, prices continued to fall, marking the 10th consecutive month of decrease. The core consumer prices, excluding food and energy prices, increased by 0.7% year-on-year in April, compared with a 0.6% rise in March. On a monthly basis, the CPI increased by 0.1%, reversing a 1.0% fall in March, which was the steepest decline in three years.

(China Inflation Rate YoY%,National Bureau of Statistics)

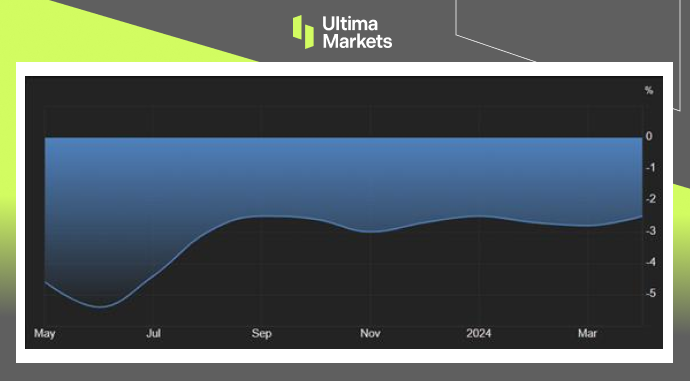

China’s producer prices (PPI) declined by 2.5% year-on-year in April 2024, exceeding market forecasts of a 2.3% fall and following March’s figure of a 2.8% decrease. It marked the 19th consecutive month of contraction in factory-gate prices, highlighting persistent economic uncertainty despite multiple support measures from the government. On a monthly basis, producer prices fell 0.2%, the sixth straight month of retreat, after a 0.1% decline in March.

(China PPI YoY%,National Bureau of Statistics)

Mainland stocks struggled to gain momentum as investors continued to assess the economic and policy outlook in China. The sentiment was further dampened by reports that the Biden administration added 37 Chinese entities to a trade restriction list on Thursday, and would possibly raise taxes on Chinese electric vehicles. The FTSE China A50 Index started the week on a weak footing, declining by 0.8%. Meanwhile, the offshore yuan weakened slightly, trading beyond 7.22 per dollar.

(FTSE China A50 Index Weekly Chart)

(USDCNY Weekly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.