Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

US Economic Momentum Slows, Rate Cut Possibility Rises

TOPICSTags: Consumer Price Index, CPI, DOW, Inflation, Nasdaq, Retail Sales, S&P 500

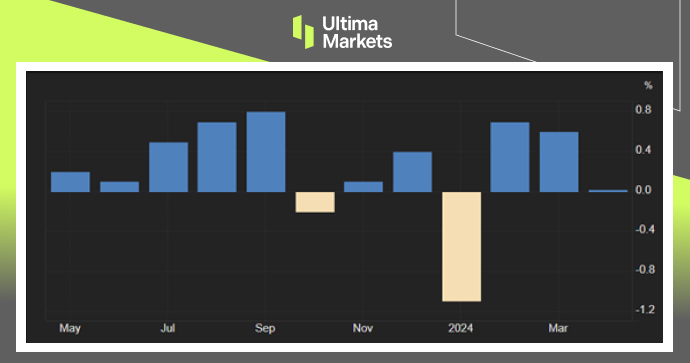

Retail sales in the United States remained flat in April 2024, showing no change from the previous month. This followed a downwardly revised gain of 0.6% in March and defied market expectations of a 0.4% rise, suggesting consumer spending has slightly eased.

Out of the 13 categories tracked, 7 posted declines. Significant drops were seen in sales at nonstore retailers (-1.2%), sporting goods, hobby, musical instrument, and book stores (-0.9%), motor vehicle and parts dealers (-0.8%), and furniture stores (-0.5%). On the other hand, sales increased at gasoline stations (3.1%), clothing stores (1.6%), and electronics and appliance stores (1.5%).

(Retail Sales MoM%,US Census Bureau)

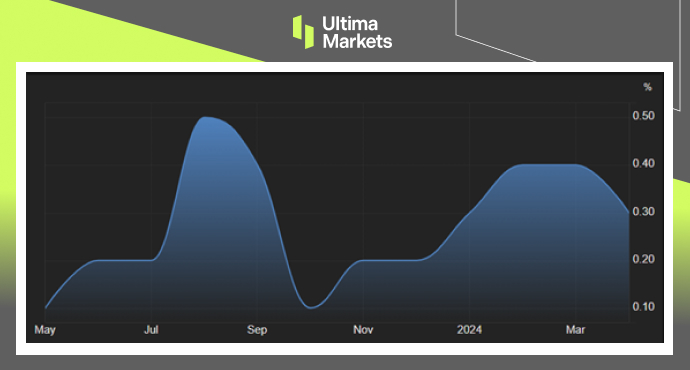

In April 2024, the Consumer Price Index (CPI) in the US saw a 0.3% rise from the previous month, which was a slight dip from the 0.4% increase in the preceding two months and also fell short of the anticipated 0.4% rise. The cost of housing rose by 0.4%, while gasoline prices escalated sharply by 2.8%. Together, housing and gasoline were responsible for more than 70% of the CPI’s monthly upsurge. Food prices, on the other hand, remained unchanged. There were price upticks in several areas, including motor vehicle insurance, which grew by 1.8%, medical care increased by 0.4%, and apparel went up by 1.2%. Conversely, there was a decline in prices for used cars and trucks, which fell by 1.4%, household furnishings, and operations, which decreased by 0.5%, and new vehicles, which dropped by 0.4%.

The annual inflation rate in the United States eased to 3.4%, down from 3.5% in March. The March figure was the highest reading since September, and the April rate of 3.4% was in line with market forecasts.

(CPI MoM%,US Bureau of Labor Statistics)

The annual Core CPI in the US, which strips out highly fluctuating costs such as food and energy, decreased to a three-year low of 3.6% in April 2024. This downshift from the previous month’s 3.8% rate aligns with expert predictions. The housing expenses, responsible for more than two-thirds of the total year-over-year rise in the index excluding food and energy, grew by 5.5% in April, a slight decrease from March’s 5.7% hike. Significant annual increases were also recorded in motor vehicle insurance (up by 22.6%), medical care (up by 2.6%), personal care (up by 3.7%), and recreational activities (up by 1.5%). For the month, core consumer prices went up by 0.3% in April, marking a slower growth compared to the 0.4% rises in March and February, which met the market projections.

(Core CPI YoY%,US Bureau of Labor Statistics)

Wednesday saw a rally in the U.S. stock market, with all three major averages closing at record highs, following the release of softer-than-expected CPI readings. The S&P 500 gained 1.17%, settling above 5,308.15 for the first time. The Dow Jones Industrial Average advanced by 349.89 points (+0.88%), while the Nasdaq climbed 1.4% higher.

(S&P500 Index Yearly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.