Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Cryptocurrency Bull Run: An In-Depth Analysis

Since the well-known cryptocurrency exchange FTX collapsed, the cryptocurrency market has witnessed twists and turns. First of all, after the FTX collapse, the prices of mainstream cryptocurrencies such as Bitcoin and Ethereum have plummeted.

But then, good news such as cryptocurrency ETFs and Bitcoin’s upcoming halving reignited the market, gradually reversing the market decline.

Although the current market is far from the apex, many financial institutions and professionals have stated that it is very likely that a big bull market will usher in.

For example, Standard Chartered Bank stated in July this year that the price of Bitcoin is expected to rise to US$120,000 in 2024; and Cathie Wood, CEO of Ark Invest, even stated that the price of Bitcoin may exceed $1 million in 2030. In mid-October, a piece of false news that the BlackRock Bitcoin ETF had been approved went viral online, temporarily leading to a skyrocket in the market.

So, what exactly led to the above-mentioned bull market expectations? Are the bull market predictions of these institutions and individuals well-founded, or are they just made casually?

This article will provide an in-depth analysis of whether the cryptocurrency market will usher in a bull market in the near future.

Bitcoin halving moment is coming

The first reason why Bitcoin may usher in a bull market is the “halving”.

Bitcoin halving refers to cutting down the Bitcoin’s mining reward by half. To translate, this means that the number of the Bitcoins that can be obtained by miners gets divided into half.

In essence, after the halving, the number of Bitcoins that can be produced in the market has been reduced by half, which is equivalent to the reduction of sellers by half, but the number of buyers has not decreased. This supply shortage effect is likely to drive the price of Bitcoins in the long run.

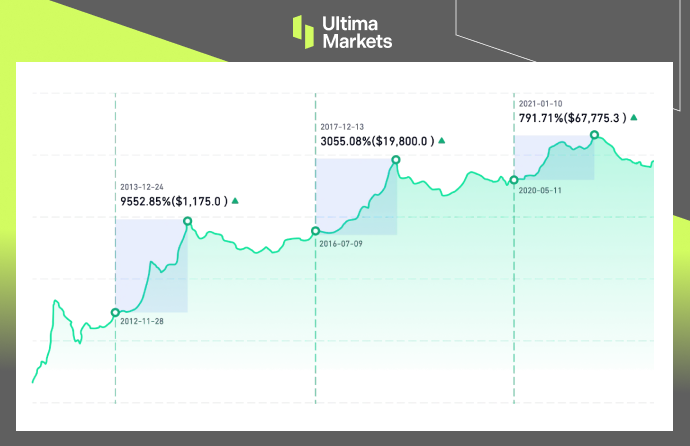

In fact, judging from historical data, after every halving of Bitcoin, its price has indeed experienced a considerable increase. The chart below shows the three halving moments that have occurred in Bitcoin’s history.

As can be seen from the figure below, the first halving occurred on November 28, 2012. Since then, the price of Bitcoin has increased, and the final increase this time was as high as 9,552.85%. The second halving occurred on July 9, 2016, with the increase up to 3,055.08%. The third halving occurred on May 11, 2020, with the final increase reaching 791.71%. The fourth halving is expected to occur around April 2024, which may once again trigger a new round of rise in Bitcoin prices.

Cryptocurrency ETFs take shape

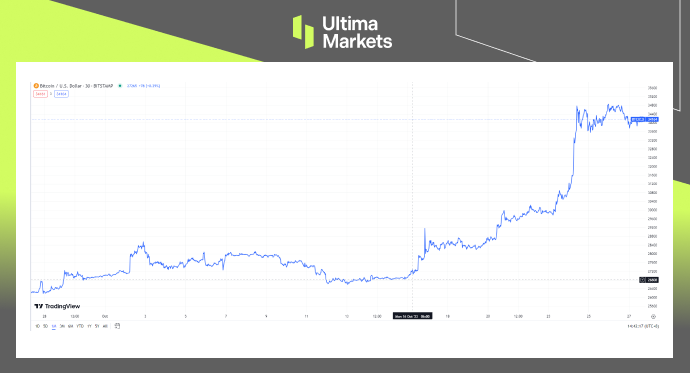

On June 15 this year, one of the most notable U.S. fund management giant BlackRock made a filing for a Bitcoin spot ETF with the U.S. SEC. Despite Bitcoin ETF application having not been fully approved yet, it is clear that the market tends to bet that the application will be approved.

However, late in October, Depository and Clearing Corporation (DTCC) had accepted to register BlackRock’s spot bitcoin ETF – iShares Bitcoin Trust. Such a development has also seen the rapid increase in the price of Bitcoin.

In the past, investment in Bitcoin and other cryptocurrencies was mostly limited to a small circle of geek investors. But once the ETF is approved, it will inevitably attract a larger amount of funds from the traditional financial institutions or common investors. And this is also likely to push up the prices of digital currencies such as Bitcoin.

In June this year, Fidelity, the top asset management company in the United States, joined several Wall Street giants to jointly launch the cryptocurrency exchange EDX. The exchange currently supports trading of 4 cryptocurrencies, namely BTC, ETH, LTC and BCH. This further reflects that mainstream Wall Street giants have started to increasingly regard cryptocurrencies represented by Bitcoin as an acceptable financial asset.

However, it should be noted that the mainstream Wall Street giants currently only recognize Bitcoin and a few other coins as the mainstream coins in the cryptocurrency market. Most other cryptocurrencies are actually not recognized yet, especially those altcoins that rise and fall at every turn. For example, the chairman of the U.S. SEC, Gary Gensler, mainly recognizes that Bitcoin should be regarded as a “commodity”, while most other digital currencies should be regulated as “securities”.

Overall, Bitcoin has been recognized as a “commodity” asset by the United States with a high probability, equivalent to the existence of “digital gold”. Under this consensus, many Bitcoin ETFs may be launched in the future, which is expected to trigger a new round of Bitcoin bull market.

The Cryptocurrency macro market is expected to improve next year, but don’t take it for granted

Most financial markets have been highly unrewarding in the last two years as the US Federal Reserve continued to raise interest rates.

The price rise for Bitcoin has touched the figure of 120% this year, which is, however, mostly explained by the anticipation related to Bitcoin halving and possible introduction of related ETFs.

As such, if the US is forced to suspend the planned rate hikes and instead opt for downward adjustments, more rises in the Bitcoins prices would be inevitable.

After all, high-interest US dollar will limit huge quantities of monies getting involved into the risk-oriented stocks, commodities, crypto-currencies.

However, it is worth noting that although all factors currently seem to be supporting the cryptocurrency market next year, this does not mean that investors can sit back and relax completely.

In the past month, affected by various good news about ETFs, halvings, etc., the prices of mainstream cryptocurrencies such as Bitcoin and Ethereum have risen significantly.

Bitcoin price is up more than 120% year-to-date, while Ethereum price up about 67% year-to-date (at the time of writing). It can be said that the cryptocurrency market has shaken off the previous depressed sentiment and has clearly shown an upward trend.

The current Fear & Greed Index for cryptocurrencies, offered by alternative.me, has risen to 71.

Therefore, we tend to deem that, driven by the current positive market sentiment, prices of cryptocurrencies such as Bitcoin are likely to continue to rise.

However, when events such as the halving and the launch of ETFs are officially implemented, the cryptocurrency market may instead experience a situation of “buying the rumor, selling the news”. At that time, the price level may actually decline due to massive selling.

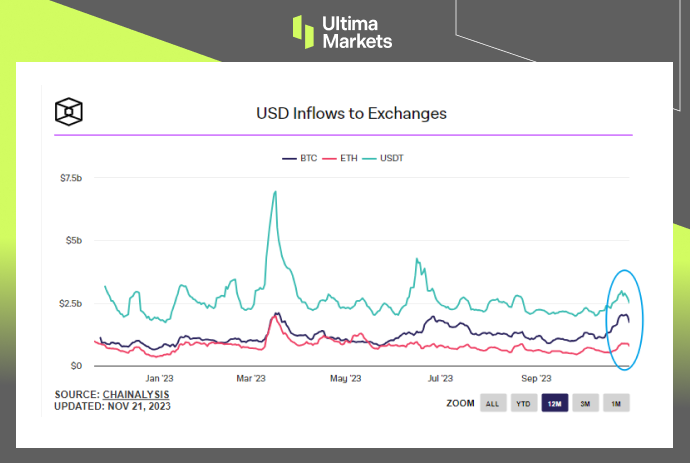

The chart below shows the changes in the amount of funds that have poured into cryptocurrency exchanges in the past year. Whenever there is an influx of funds into an exchange, it often indicates that investors are looking to sell cryptocurrencies on the exchange, which creates selling pressure and causes downward price levels.

The current amount of Bitcoin funds pouring into exchanges is close to the peak in the past year. Therefore, in the short term, Bitcoin may face a larger price correction before the halving and the implementation of ETFs.

In short, the cryptocurrency market does have relatively reliable supporting factors in the medium and long term, which may support its price level to rise in the long term.

However, in the short term, investors need to pay close attention to the current on-chain data to avoid being caught off guard when a price correction suddenly occurs.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.