You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

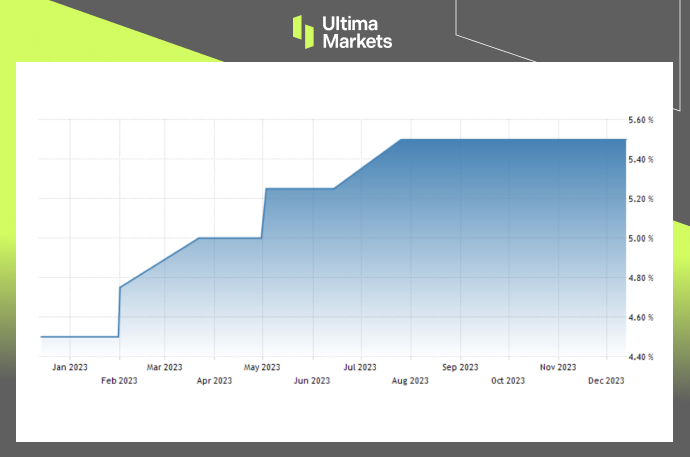

Federal Reserve Holds Rates Steady, Signals End of Hiking Cycle

The Federal Reserve’s recent decision to maintain the federal funds rate has sparked discussions about the trajectory of economic indicators and the potential for future rate cuts.

In this article, we delve into the key aspects of the Federal Reserve’s December meeting, examining economic projections, inflation trends, and the overall outlook for the US economy.

(US Federal Funds Rate, FED)

US Economic Projections and GDP Growth

At the heart of the December meeting were updated economic projections, shedding light on the Federal Reserve’s perspective on the country’s economic landscape. The Summary of Economic Projections, December 13, 2023 provides a detailed breakdown of these projections. Notably, GDP growth forecasts have been revised, with an optimistic outlook for 2023 but a slightly tempered expectation for 2024.

Inflation Trends: PCE and Core PCE

Central to the Federal Reserve’s decision-making is the analysis of inflation trends, particularly the Personal Consumption Expenditure (PCE) and Core PCE inflation rates. The Monetary Policy Report – June 2020 gives insights into the medians of projections for these key indicators.

Recent data, as discussed in Fed’s favorite gauge shows inflation rose 0.2% in October, indicates a nuanced approach by the Fed, favoring the core PCE reading over the consumer price index.

The Fed lowers inflation forecast for 2024, signaling a decline to 2.4%, aligns with the overall trend of moderating inflation expectations.

Unemployment and Federal Funds Rate

Examining the Slower GDP Growth, Falling Inflation in 2024 Outlook report from the Federal Reserve Bank of St. Louis provides insights into unemployment rate projections. The forecast suggests a slow upward drift to an average of 4.2% in 2024, emphasizing a nuanced approach to economic forecasting.

Additionally, the Monetary Policy Report: Using Rules for Benchmarking by the Federal Reserve Bank of Philadelphia highlights expectations for the federal funds rate, indicating a potential surprise hike.

Economic Outlook and Future Expectations

For a broader perspective on the economic outlook, the An Update to the Economic Outlook: 2023 to 2025 by the Congressional Budget Office outlines the growth rate of the PCE price index, a key metric for assessing inflation. It emphasizes the importance of the PCE inflation measure in understanding the economic landscape.

Additionally, insights from Charting the Economy by the Federal Reserve Bank of Kansas City offer a visual representation of how a surprise hike in the federal funds rate can impact headline personal consumption expenditure (PCE) inflation.

Frequently Asked Questions

Q: What is the Federal Reserve’s preferred measure of inflation?

A: The Federal Reserve favors the Core PCE inflation reading over the consumer price index, as discussed in Fed’s favorite gauge shows inflation rose 0.2% in October.

Q: How has the Fed adjusted its inflation forecast for 2024?

A: The Fed lowers inflation forecast for 2024, anticipating a decline to 2.4% in 2024.

Q: What are the expectations for the federal funds rate?

A: Insights from the Monetary Policy Report: Using Rules for Benchmarking suggest potential changes in the federal funds rate, indicating a nuanced approach to benchmarking.

Bottom Line

In conclusion, the Federal Reserve’s recent decisions and economic projections paint a complex picture of the US economic landscape. From GDP growth to inflation trends and the federal funds rate, multiple factors are at play.

Staying informed about these dynamics is crucial for businesses and individuals alike, especially as the Fed signals a potential end to the current hiking cycle.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.